#Operating cash flow meaning free

does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Accordingly, the information provided should not be relied upon as a substitute for independent research. does not have any responsibility for updating or revising any information presented herein. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Applicable laws may vary by state or locality. Additional information and exceptions may apply. This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. Forecasting can also help you determine future financing activities and examine which expenses you can afford. When done effectively, your cash flow forecast should help give you a better picture of your working capital and expectations. Forecasts should narrowly estimate all business income and operating expenses on a monthly or quarterly basis. This analysis can help ensure your small business has enough incoming cash to handle the next month’s obligations.Ĭash flow forecasts are similar to ordinary business budget plans.

The Small Business Administration (SBA) recommends performing a cash flow analysis monthly.

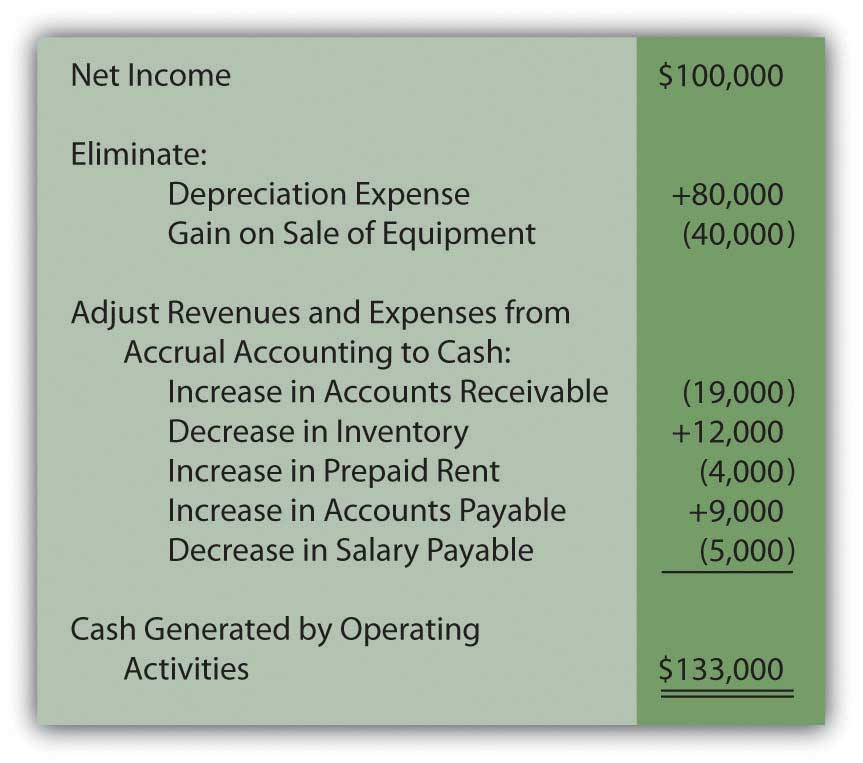

To create better projections, examine your current cash flow by creating a cash flow statement (or statement of cash flows).Ī cash flow statement shows how shifts in balance sheet accounts and income impact cash and cash equivalents. The only way to achieve healthy cash flow is by implementing and regularly operating with a cash flow forecast. Matched fluctuation in revenue and operating expenses mark healthy cash flow. Cash flow measures all expenses that go in and out of your business within a specified period.

0 kommentar(er)

0 kommentar(er)